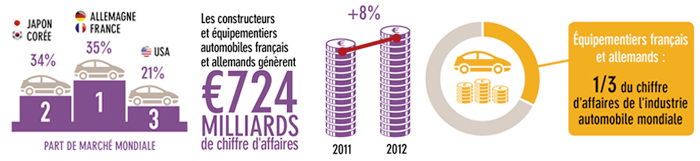

How do the French and German automotive industries compare?

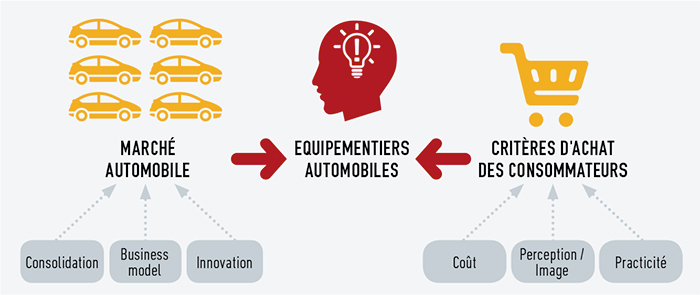

To support global manufacturers, Germany and France have built a solid network of dynamic and innovative suppliers. These actors are at the core of the challenges that the automotive industry faces and helps to build its new ecosystem.

Mazars conducted a study investigating the factors underlying the performance of two key automotive players: France and Germany.

Mazars wanted to put the spotlight on German and French suppliers by comparing their positions, results and growth forecasts. This study highlights the different mechanisms used at the source of their performance and identifies expected developments in 2014 and beyond. This is based on a thorough analysis of the financial results of 30 major German and French automotive OEMs & Suppliers and individual interviews conducted by Mazars leaders.

The findings are rich on both sides.