Recommendations for preparing Transfer Pricing reporting for the year 2022

We have created these recommendations to facilitate the work of finance departments, simplify the process of preparing controlled transactions reports, and save your time searching for necessary information.

All the recommendations and advice have been prepared by our team, which possesses extensive experience in working with transfer pricing reporting and a deep understanding of the legislation.

In the document, you will find:

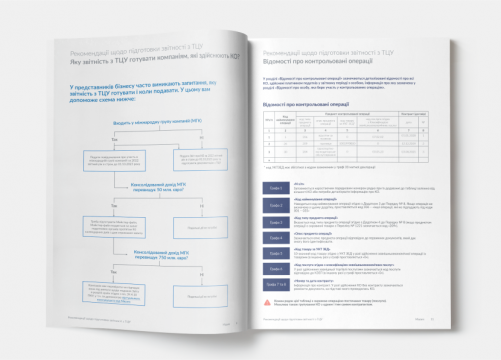

- Recommendations on completing the Controlled Transactions Report.

- Information on self-adjustment of income tax liabilities.

- A presentation of our innovative tool for self-analysis of business transactions and counterparts.

We do not send spam and do not share your data with third parties. Your privacy is important to us.